Please do not reply to this Newsletter. You will likely get a response from a machine, not Nancy! For

feedback on the Newsletter or to correspond with Nancy, click here instead.

Yuan Yin-Yang

China holds a club over the White House and US Congress. China has supported the US debt by

buying immense amounts of US bonds. In that the US buys goods from China, China also has US

dollars in its reserves. Is this to China's advantage? In that the dollar is dropping, steadily, China in fact

loses money by holding US dollars and bonds. Bonds are worth less when cashed in than when

purchased, and each dollar held drops in values as time passes. Many countries are switching to using

the Euro to avoid holding dollars, and oil producing nations are allowing the purchase of their oil in Euros

or currencies other than the dollar. Nobody wants to be caught holding a commodity that is dropping in

value! China has hitched their yuan to the US dollar, so their goods will continue to be attractive in price

to US buyers. Their goods remain cheap in the US. The US buys Chinese goods, but the reverse is not

true. China is not buying relatively expensive US goods. This is referred to as the "trade imbalance". The

US also wants China to free the yuan from the dollar so what they owe China for US bonds will be less

in true value. As time passes, the US will owe China less and less for the bonds they hold, which will

shrink in relative value. Another step in the yin-yang dance is the huge US dollar reserves that China

holds, as sales to the US are done in dollars. If China tries to dump their reserves of US dollars,

exchanging these dollars for another currency, this flood on the market will cause the US dollar to plunge

further. China and the US are thus in a nervous yin-yang dance. China is refusing to unhitch the yuan

from the dollar, and threatening to dump their dollar reserves. The US is threatening to impose trade

sanctions against Chinese imports.

- China Threatens "Nuclear Option" of Dollar Sales

Aug 8, 2007

http://www.telegraph.co.uk/money/main.jhtml?xml=/money/2007/08/07/bcnchina107a.xml

- The Chinese government has begun a concerted campaign of economic threats against the

United States, hinting that it may liquidate its vast holding of US treasuries if Washington

imposes trade sanctions to force a yuan revaluation. Two officials at leading Communist

Party bodies have given interviews in recent days warning - for the first time - that Beijing

may use its $1.33 trillion of foreign reserves as a political weapon to counter pressure from

the US Congress. Shifts in Chinese policy are often announced through key think tanks and

academies. Described as China's "nuclear option" in the state media, such action could

trigger a dollar crash at a time when the US currency is already breaking down through

historic support levels. It would also cause a spike in US bond yields, hammering the US

housing market and perhaps tipping the economy into recession. It is estimated that China

holds over $900 billion in a mix of US bonds.

Does China consider the trade imbalance, where they have a certain market in the US for their goods, a

type of payment for helping the Bush administration out with their monstrous national debt? Certainly,

holding US bonds are not a good deal for China. Paulson, speaking for the White House, does not

seems to want to aggravate China, but the US Congress is getting upset over the trade imbalance.

- Paulson Warns Lawmakers on China Trade Bills

August 7, 2007

http://www.reuters.com/article/politicsNews/idUSN0723686220070807

- U.S. Treasury Secretary Henry Paulson warned on Tuesday it was a mistake for U.S.

lawmakers to blame American job losses on global competition and use it as an excuse for

passing protectionist trade laws aimed at China. But a key senator rebuffed his advice that

the United States should stick with a strategy of negotiation and dialogue to persuade

Beijing to let its yuan currency strengthen, saying a firmer hand was needed. Baucus, a

Montana Democrat, and many other lawmakers believe that China deliberately

undervalues its currency to make Chinese goods cheaper in U.S. consumer markets,

hurting American competitors.

The Zetas have addressed this Yin-Yang dance, and how it might spin out of control.

ZetaTalk Explanation 6/9/2007: China is a great worry for the Bush White House, not at all in

control, the sleeping dragon awakened. China has been buying immense amounts of US bonds,

and holds an immense amount of US dollars as a result. If they stopped buying these bonds, even

at the reduced rate they have assumed, or started dumping dollars, they would devastate the US

in a dropping dollar. Where this makes US manufactured goods cheaper worldwide, it makes US

stocks and bonds worthless, and panic would set in. Bush knows this, but is smug in his

knowledge that the Puppet Master does not want such a financial crisis. Thus, he antagonizes

China like a little dog yapping at a bound and caged bear. We have the pet food fiasco, which

they chose to blame on China food imports, when it was clear that only pet food was involved

and this with a US nod in fact! Food shortages are to be disguised, no one to notice, and the bad

food is thus not to be wasted. Little tit for tat games have begun, with China claiming some US

foods or products are not safe, and the US continuing to make claims about Chinese products

like toothpaste. All of this is exaggerated if not frankly made up. So given this scenario, what are

Chinese leaders and Bush talking about, face to face?

How it will go down, when the spiral starts. What was open ended was how the financial spiral

would affect the US and China. At some point banking failures will result, but as with the many

bank failures during the Great Depression, if no one calls them on their failure, they struggle

along, the public none the wiser. Banks will have limited hours, limited withdrawals, and those

trying to sell stock simply finding no buyers. For China, this means the dollars they hold will

become worthless, the US refusing to exchange them for anything of worth, and likewise with the

rest of the world. The dollar, like the stock market, may reflect on paper a value higher than it

has, but no one will want to exchange anything of worth for dollars, a similar reaction to US

stocks. What you hold is worthless, regardless of its face value. Given what is expected to happen

during the pole shift, during the weeks preceding the pole shift, that all paper money will lose its

value, this is not deemed a problem. It is the short term that Bush worries about, how quickly he

will have to move to limited banking within the US, how he will have to react to demands from

other countries to cash in US bonds for something of worth, like gold. He wants other countries

to suffer but not him, as usual. He did not find a sympathetic ear! As China is squeezed, it will

stop buying US bonds, forcing the US to print money faster, with higher inflation, and the spiral

they wish to delay starting early and accelerating.

Housing Bubble Bust

Suddenly, easy credit for a mortgage is a thing of the past. Assists like allowing no down payment or

balloon mortgages where the interest and payments are low at first - stopped. Credit has tightened.

Why? Because the bubble has burst, and inflated housing prices are plunging. Per the Zetas, this bubble

was allowed to develop in the first place so that the Bush economy would look healthy. Construction on

new housing was booming.

Question: Can the Zetas comment on how the housing market (and the economy that depends

upon it) can continue to stay afloat with the subprime mortgage crisis and many many homes

going into default on a daily basis? It seems as there is no one single control point for the market

for housing to be rigged as the stock market is, that housing must eventually find its own level

(presumably much lower). Are financial institutions continuing to carry foreclosed properly on

the books at higher and higher levels to avoid a collapse?

ZetaTalk Prediction 6/2/2007: The real estate market in the US has indeed been inflated above its

value by easy money, no down payment and easy terms for the first few years. All this was

designed, like the inflated value of stock, to keep the illusion of an economy perking along out

there. The crew at the helm of these devices felt this day would never come! They felt that the

pole shift, the last weeks, would occur long before this time. Thus the US has borrowed until no

one wanted to lend anymore, then has been printing money so the value of each dollar drops

faster, like a banana republic. Remember that during the Great Depression, most banks failed,

most farms and businesses were bankrupt, but unless the credit holder called in the debt, this did

not result in a bankruptcy! The situation was ignored, until the farm or business or bank could

become solvent again, and all breathe a sigh of relief. For real estate, there are profiteers who

will take the property to make a profit, but for many, terms will be worked out! No one involved

wants this to be a smear on the Bush administration, who created this mess, so they will find

loose money and have the mortgage holder sell their souls to stay in the house.

So what has been happening since June? Interest rates went up, credit approval tightened, and over 100

loan companies went into default to some degree!

- August 7, 2007

http://ml-implode.com/

- The imploded status is somewhat subjective and does not necessarily mean operations are

ceased permanently: it can mean bankruptcy filing, temporary but open-ended halting of

major operations, or a firesale acquisition. The companies include all types (prime,

subprime, or a mix of both; retail or wholesale; subsidiaries and entire companies). Note:

companies listed here may still be operating in some capacity; check with them before

making assumptions.

Imploded Lenders:

112. HomeBanc Mortgage Corporation

111. Mylor Financial

110. Aegis (Everything)

109. Alternative Financing Corp (AFC) Wholesale

108. Winstar Mortgage

107. American Home Mortgage / American Brokers Conduit

106. Fieldstone Mortgage Company

105. Nations Home Lending

104. Wells Fargo Alternative Lending Wholesale

103. Entrust Mortgage

102. Flick Mortgage/Mortgage Simple

101. Alliance Bancorp

100. Choice Capital Funding

Despite the struggle, the Federal Reserve has refused to lower interest rates, citing concerns about

inflation. The housing bust was termed a "correction".

- Fed Holds

August 7, 2007

http://urbansurvival.com/week.htm

- The Federal Open Market Committee decided today to keep its target for the federal funds

rate at 5-1/4 percent. Economic growth was moderate during the first half of the year.

Financial markets have been volatile in recent weeks, credit conditions have become

tighter for some households and businesses, and the housing correction is ongoing.

Utah Mine Collapse

On August 6, 2007 the USGS registered a 4.1 quake in Utah, at the site of the Crandall Canyon Mine

which had a simultaneous cave-in. The mine operator is in a dispute with the USGS over whether the

quake caused the cave-in or the cave-in was merely registered as a quake.

- Rescuers May be 3 days from Trapped Utah Miners

August 7, 2007

http://www.reuters.com/article/bondsNews/idUSN0727143320070807

- Six miners remained trapped deep in a collapsed mine in Utah late on Tuesday as

frustrated rescuers said it could take several more days to reach the men -- if they are still

alive -- and even longer to get them out. No contact has been made with the miners,

stranded 1,500 feet below the surface, in the 36 hours since the Crandall Canyon Mine

caved in on Monday -- though officials say the six men could survive for weeks in an

underground chamber. A bitter dispute erupted over the cause of the accident, with the

mine's owner insisting an earthquake was responsible after geologists had said seismic

activity detected at the same time was probably caused by the cave-in itself. In the

meantime, some 135 rescuers and mine employees used equipment placed on the side of the

mountain by helicopter to drill directly downward toward the trapped men, hoping to at

least provide them ventilation and water.

-

- Seismic Activity Stops Mine Rescue Try

August 7, 2007

http://www.breitbart.com/article.php?id=D8QSHOTG0&show_article=1

- Seismic activity has totally shut down efforts to reach six miners trapped below ground

and has wiped out all the work done in the past day. Rescue crews are drilling two holes

into the mountain in an effort to communicate with the miners-provided they are still alive.

Meanwhile, unstable conditions below ground have thwarted rescuers' efforts to break

through to the miners, who have been trapped 1,500 feet below the surface for nearly two

days. But government seismologists have said the pattern of ground-shaking picked up by

their instruments around the time of the accident Monday appeared to have been caused

not by an earthquake, but by the cave-in itself.

What would cause such a cave-in in Utah, considered solid ground? The Zetas stressed in February that

the Phoenix Lights redux UFOs were a warning about future changes in the southwest, a bowing in the

land from Mexico to northern California which would ultimately cause the Hoover Dam to break.

ZetaTalk Explanation 2/10/2007: And why the anniversary blitz of Phoenix lights? Is not the flat

dry desert of Arizona expected to remain relatively undisturbed, during the coming pole shift?

When the New Madrid Fault adjusts, Mexico will be too far to the West for the current comfort

of the West Coast, which will bow in the Southern California and Arizona region. The fault line

that runs along Mexico's west coast runs just under the Arizona border, then on up along the

west coast of California. Before the west coast of the US starts adjusting to the new position of

Mexico, with slip-slide adjustments, there will be a bending of the Arizona desert area that will

fracture the dry soil, create a breach in the great Colorado River dam, and allow magma to rise

in the calderas in the US - Mammoth Lake in California and Yellowstone. If the Hoover Dam

breaks, whither the city of Phoenix, which lies on flat land and near farm land irrigated by the

waters of the Colorado?

If rock on the eastern shores of the Mississippi River can shift to the east, causing the collapse of the

I35W bridge, would such a bowing of land near Arizona cause a long stable coal mine to collapse so

resoundingly that it masks a 4.1 earthquake?

ZetaTalk Explanation 8/8/2007: We are often asked how to determine safety in mountain building

areas. Should one stand on a peak, or seek shelter in a valley? This is not a simplistic matter, and

it is impossible to state general guidelines or even to give advice for a particular area. Hidden

weak spots in the rock layers below might exist, undetectable even for ourselves, the Zetas, and

suddenly allow a cave-in or shift. This is what occurred at the Crandall Canyon mine. The great

salt flats in Utah show that they can withstand buckling, and have done so through several pole

shifts. Mountain ranges in the western US are termed new mountains as their edges are sharp

rock, showing recent fracturing. Rock layers that are compressed, in the compression zone, will

do one of two things. If hard enough, they will remain as flat land, as the salt flats have done,

forcing the compression onto the surrounding areas. If able to be fractured, the weak link, they

will fracture and throw portions of the layer up on top of other parts of the layer, thus creating

mountains from flat land. Crandall Canyon lies to the east of the Great Salt Lake Desert, and

passes on any stress created due to the bowing of land in the southwest we have predicted to the

mountains to the east of these salt flats. The weak link gives. The New Madrid Fault adjustments

we have predicted to occur soon will not just suddenly happen one day. They will be preceded by

minor adjustments in the stressed rock. Weak points snap, one after the other, until such minor

adjustments no longer suffice. The bridge collapse in Minneapolis, and this mine cave-in, are just

a small preview of what is to come!

German Circles

Two recent crop circles in Germany, on July 25, 2007 in Lower Saxony and on July 28, 2007 in

Bavaria, have a common theme - a larger ball or impression on the right, a smaller ball or impression on

the left.

ZetaTalk Explanation 8/11/2007: We have stated that as Planet X proceeds in its 270° roll,

pointing its N Pole increasingly toward Earth, that the Earth will put distance between itself and

Planet X, as much as possible. This will push the Earth to the left, with its N Pole leaning to the

left, to escape the hose of magnetic particles coming from the N Pole of Planet X. Eventually,

this distance will place the planets in the arrangement we have described as the ZetaTalk

Triangle. What is the relative strength of the magnetic fields involved, as this point is

approached? At present, the Earth is the lesser influence. Planet X is at least twice as strong a

magnetic field, at its current distance. And the Sun is the dominant influence, by far, over both

planets.

Orangutan Charades

Where apes such as orangutans or chimpanzees cannot speak or write, research has shown they can

point to symbols to communicate, and use tools to get what they want. Apparently, they also can play

charades!

- Orangutan Charades

August 2, 2007

http://www.st-andrews.ac.uk/news/Title,14765,en.html

- Orangutans communicate as if they were playing charades. When using gestures to get

their points across, orangutans rely on the same basic strategy that humans follow when

playing the popular game and intentionally modify or repeat hand (or other) signals based

on the success or failure of their first attempt. The findings are published in today's edition

of Current Biology (2 August 2007).

Per the Zetas, this should be no surprise.

ZetaTalk Explanation 8/4/2007: When man was genetically engineered from apes, it was because

the ape had the potential for thought, for puzzle solving, and was not a long way from being

conscious of itself as an entity apart from others in its species. Sparking souls require all these

things, and the ape was a step away. Humans read body language, more so than they realize.

Humans use tools and language. Thus it is no surprise that apes would have these capabilities to

some extent.

Red Dust Evident

Planet X is shrouded by a huge dust cloud of oxidized iron particles, the red dust or legend that turns

ponds and rivers blood red during a passage. The Zetas have warned that the tail is increasingly turning

toward us as the N Pole of Planet X turns toward us. This is because the dust cloud is pushed away

from Planet X by the hose of magnetic particles coming from the N Pole of Planet X. Blood red sunsets

and a blood red moon were noted recently on the Surfing the Apocalypse message board, postings

dated August 1, 2007.

The sun is setting right now in Central Europe and it is blood red and glowing.

[and from another] I walked out onto the deck, night before last, to see the moon

rising here in France. The color was striking and this photo does not do it justice.

It was much redder to the eye. I know that atmospheric pollution has much to do

with this effect, but I have never seen it quite so vividly colored before. [and from

another] I live in Ohio, and we had a full moon Sunday night, and it was the same

way. Blood red and big. I couldn't believe it. It was mesmerizing. Beautiful. I did

wonder why that was?

I received at least two more such comments via email.

Sun is quite red this morning here in just west of Chicago. Redder than I

remember ever seeing, but not quite as red as a couple evenings ago when it was a

bright bloody red, so much so it actually startled me. [and from another] This

picture was taken by my girlfriend on July 31, 2007 in Sheboygan, WI. She

commented on how the sun seemed almost oval and very red.

The dust turning the sunset and moon blood red is dust within the atmosphere, but the red dust

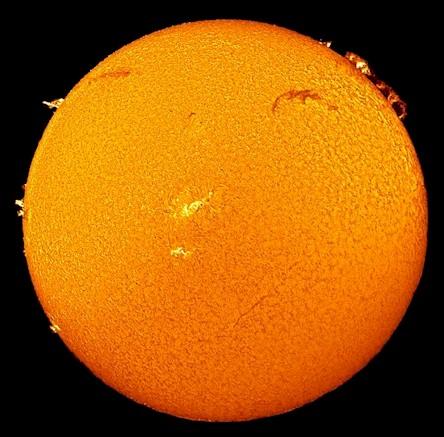

shrouding Planet X also colors a direct view of the Sun in clear skies. The Zetas have stated that Planet

X is virtually between the Earth and the Sun, slightly to the right as it is coming toward the Earth in a

retrograde manner, and close to the Ecliptic, the Sun's middle. A distinct reddish glow can be seen on

the Sun's lower right quadrant, when viewed from Earth, from the dust cloud wafting in that area. This

was noted on May 28, 2007 by someone looking at the Sun with a pair of solar binoculars.

There is an ever so subtle red shading on the sun's south east quadrant. The edge

of the sun is crisp and white on the other three quadrants, but the lower right (and

depending on time of day, the shading moves north to be almost due east) is

slightly fuzzy with a reddish hue. This anomoly is consistent - and is there every

time I look. Also, if the binoculars are turned upside down, the view is the same -

so it is not defective lenses. Actually, I accidentallly received two of these

binoculars (you know how some websites warn about clicking twice could result in

multiple orders) - and both pairs show the same thing.

And this was also captured on film by another individual using a SolarMax 90 camera, a confirmation of

the earlier report.

You received this Newsletter because you subscribed to the ZetaTalk Newsletter service. If undesired, you can quickly

Unsubscribe.

|