International Panic

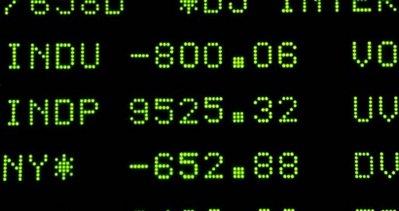

Despite the passage of Treasury Secretary Paulson's bailout package, stock markets around the world

went into a panic. If companies on Wall Street, the world's premiere market, were going down, then

what's next? Panic resulted in panic selling, which ricocheted around the world. In Europe, this panic

was reflected in significant market losses. Low points occurred during October 6-7, 2008 when the

DOW dropped 8%, Russia's market dropped 19%, Brazil plunged 15%, Iceland 20%, Japan 10%,

and Indonesia 10%.

- Markets Routed in Global Sell-off

October 6, 2008

http://www.ft.com/cms/s/0/c9a27b24-93d1-11dd-b277-0000779fd18c.html

- Stock prices collapsed around the world on Monday amid growing fears that the credit

crisis would trigger a global recession. The FTSE Eurofirst 300 index had its third worst

day ever, plunging 7.75 per cent, as France's CAC 40 slumped 9 per cent, its second worst

day on record. In London, the FTSE 100 suffered its biggest one-day points loss. The Dow

Jones Industrial Average closed down 3.6 per cent at 9,955.50 after falling as much as

7.75 per cent, to 9,525.32, during the day. Trading was temporarily stopped in some major

emerging economies, including Russia, where the market fell by just over 19 per cent, and

Brazil, where stocks fell as much as 15 per cent before closing 5.4 per cent lower. Earlier,

Japan's benchmark Nikkei 225 index plunged 4.3 per cent to a 4½-year low. Jakarta

suffered a 10 per cent drop.

The dollar rose in relative value Against Iceland and Australia as their currency crashed.

- Markets Routed in Global Sell-off

October 6 2008

http://www.ft.com/cms/s/0/c9a27b24-93d1-11dd-b277-0000779fd18c.html

- In Iceland, the currency fell 30 per cent.

-

- British Banks Lead Europe Markets Lower

October 7, 2008

http://biz.yahoo.com/ap/081007/world_markets.html

- The Australian dollar slumped by nearly 10 percent Monday.

Retirees have seen up to 20% of the value of their portfolios evaporate.

- Retirement Accounts Have Lost $2 Trillion

October 7, 2008

http://www.huffingtonpost.com/2008/10/07/retirement-accounts-have_n_132737.html

- Americans' retirement plans have lost as much as $2 trillion in the past 15 months _ about

20 percent of their value _ Congress' top budget analyst estimated Tuesday as lawmakers

began investigating how turmoil in the financial industry is whittling away workers' nest

eggs. More than half the people surveyed in an Associated Press-GfK poll taken Sept.

27-30 said they worry they will have to work longer because the value of their retirement

savings has declined. The fear is well-founded. Public and private pension funds and

employees' private retirement savings accounts - like 401(k)'s - lost about 10 percent

between the middle of 2007 and the middle of this year, and lost another 10 percent just in

the past three months, he estimated.

Phew. The Pope took the opportunity to remind his flock that clinging to financial instruments is building

a house on sand.

- Pope Says World Financial System 'Built on Sand'

October 6, 2008

http://www.timesonline.co.uk/tol/comment/faith/article4893190.ece

- Pope Benedict XVI today said that the global credit crisis shows that the world's financial

systems are "built on sand" and that only the works of God have "solid reality". Opening a

Synod of Bishops in the Vatican the Pope referred to a passage from St Matthew's Gospel

on false prophets, saying ''He who builds only on visible and tangible things like success,

career and money builds the house of his life on sand''.

On this point, the Zetas and the Pope agree. Per the Zetas, cash, stocks and bonds, precious metals,

and the value of jewelry, antiques, and paintings - all are structured on a house of cards that has at its

base confidence that the value of these items will not fall. But what if confidence does fall, evaporates,

and these items become worthless? The Zetas recommend investing in items that will hold their value

after the pole shift - seeds, gardening tools, hand tools, skills in gardening and the ability to build a

windmill from old car parts, fish hooks, herds of goats and flocks of chickens and ducks. Even items as

humble as needle and thread will have great value when one cannot simply go shopping for new clothes.

A treadle sewing machine, which does not require electricity, combined with skill in laying patterns over

old scraps of cloth will have greater value than bars of gold after the pole shift. The current economic

crisis is a reminder of that.

ZetaTalk Opinion 9/17/2004: The banking system or any paper money system is built on

confidence, confidence that a note will be paid out in something solid, something other than a

paper promise, which is what all money systems and bank notes are. As can be seen when whole

countries default on the paper money they float out under their flag, the value of a dollar can

collapse quickly. Argentina is a case in point, the money becoming worthless almost overnight. In

days past, when banks and paper money were closely tied to things, such a panic would result in

the banks who had loaned money to farmers demanding payment in things, and any who

deposited savings in the banks demanding payment in things, so that at the end of the shuffle

those having made savings deposits would find themselves with a herd of cattle or some acreage,

rather than paper money. When money became unhinged from solid backing, speculation crept

in, resulting in inflated stocks, loans without collateral, a pyramid scheme that is a house of cards

that would collapse with few left after the shuffle with anything solid in their hands. Most would

be left holding worthless notes, uncollectable, standing atop a deep pile of bankruptcies.

During the Great Depression, the world was not beset with natural disaster after natural

disaster, as is starting to occur today. Commerce, trade, was reduced due to lack of confidence

but at the base, the economies were solid and recovery followed renewed confidence. Today, all

countries are in a crisis affecting their base economies. We mentioned that crop failure would

follow the irregular weather, and it did. But buildings collapsing in earthquakes, trains running

off suddenly twisted tracks, factories exploding as gas lines breach, and storms tearing at

coastlines without remorse do more than represent an opportunity to rebuild. They represent

insurance companies unable to pay for rebuilding, factories laying off workers or unable to

function, and distribution of goods blocked. In other words, paralysis, rather than a fever of

economic activity, results.

International Rescue

Aggressive steps were taken by the central banks of many countries to lower interest rates and pump

liquidity into their banks. Britain, Australia, S Korea, the US, Canada, Sweden, Swizerland, and Hong

Kong dropped their interest rates to encourage economic activity.

- British Banks Lead Europe Markets Lower

October 7, 2008

http://biz.yahoo.com/ap/081007/world_markets.html

- European stocks shed early gains Tuesday as ongoing fears about the health of the

banking system, particularly in Britain, offset hopes that the world's leading central banks

will follow Australia's lead and cut interest rates aggressively. RBS was not the only British

banking stock in trouble amid news reports that the chief executives of Britain's largest

banks met up with British Treasury chief Alistair Darling and Bank of England governor

Mervyn King Monday night to discuss the possibility of the government providing funding

in exchange for stakes in the banks. The Reserve Bank of Australia surprised markets when

it slashed its key rate a full percentage point to 6 percent -- its biggest cut since 1992.

-

- Fed Joins 5 Central Banks - Cuts 1/2 point and Cites 'Intensification' of Crisis.

October 8, 2008

http://money.cnn.com/2008/10/08/news/economy/fed_move/index.htm

- The Federal Reserve, working in coordination with other central banks worldwide, enacted

an emergency interest rate cut. The Fed lowered its fed funds rate by a half percentage

point to 1.5%. The central bank's statement said the move was necessary because of the

worsening crisis in global financial markets. The fed funds rate is the central bank's main

tool to affect the economy. Lowering the rate pumps money into the economy by reducing

the borrowing cost on a broad range of loans, including credit cards, home equity lines and

many business loans. The moves were made in coordination with other central banks

around the world including the European Central Bank and Bank of England. The Swiss,

Canadian and Swedish central banks also made cuts.

Germany, Ireland, the Netherlands, Denmark, Sweden, Austria, and Greece moved to guaranteed

deposits and reassure depositors, preventing bank runs.

- Markets Routed in Global Sell-off

October 6, 2008

http://www.ft.com/cms/s/0/c9a27b24-93d1-11dd-b277-0000779fd18c.html

- Across Europe, governments followed Germany's weekend move to guarantee retail

savers' deposits, with similar steps taken in Denmark, Sweden and Austria.

-

- Germany Takes Hot Seat as Europe Falls into the Abyss

October 6, 2008

http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/

- Chancellor Angela Merkel has been forced to pull her head out of the sand, guaranteeing

all German savings, a day after she rebuked Ireland for doing much the same thing.

During the past week, we have tipped over the edge, into the middle of the abyss. Systemic

collapse is in full train. The Netherlands has just rushed through a second, more sweeping

nationalisation of Fortis. Ireland and Greece have had to rescue all their banks. Iceland is

facing an Argentine denouement.

Though Paulson's bailout bill is intended to relieve the US banking system of its toxic debt - mortage

foreclosures on overinflated real estate - Paulson found he could not wait to pump liquidity into the

system. The Paulson bill was going to take months to take effect, and the US could not wait.

- Federal Reserve Unveils Short-Term Loan Plan

October 7, 2008

http://www.huffingtonpost.com/2008/10/07/federal-reserve-considers_n_132501.html

- To help ease credit stresses, the Fed announced Monday it will provide as much as $900

billion in cash loans to banks. Most of the loans are for 28-days and 84-days. Some are

shorter, 13-day and 17-day loans.

How did we get here, and will we return to the roaring 20's, the roaring 90's and the real estate boom

under Bush? Per the Zetas, what should be considered are the increasing Earth changes, which will

prevent a return to boom times. There won't be a crash where the dollar is worthless and the markets do

not exist, but the boom times won't return.

ZetaTalk Analysis 10/11/2008: Frantic to avoid the mistakes made during the Great Depression,

central banks and governments around the world are pumping liquidity into their banking

systems - inflation dangers be damned. Will this work? It can't hurt, but the overall cycle will not

change. Where this current cycle is blamed on the subprime mortgage mess, the big lie where

mortgage backed securities were packed with sure-to-fail mortgages but labeled as prime

mortgage securities, there were many other causes for this economic downturn. We stated almost

a decade ago that the world was heading into a depression, and this was based on an analysis of

what business had to deal with as the Earth changes started to bite.

For one, crop failures were about to occur, caused by the erratic weather, swings of drought and

deluge, rainstorms drowning crops and intractible droughts frying crops beyond the hope of

recovery. Frosts come late and warm winters mocked an early spring, destroying crops such as

tree fruit and winter wheat. The effect is an increased price of food, worldwide, due to shortages

and the need to replant and pay higher insurance premiums. Money spend on food is diverted

from other commodities, squeezing markets.

Second, physical damage to business and industry during earthquakes and storms have been on

the uptick. Snapping fuel and chemical delivery lines caused factory explosions, city streets

imploded when steam vents were broken, and buildings slumped into sinkholes. Where this has

been treated as individual disasters by the media, rather than a trend, the effect of this steady

drip of disaster on business and industry is expense so that bankruptcies are on the increase. This

then results in job loss - unemployment and loss of a tax base.

Third, the Bush administration deliberately bankrupted the US in order to support their oil grab

in the Middle East. They knew the pole shift was coming, but did not have a firm date other than

our White Lie stating that the pole shift would occur "shortly after May 15, 2003". Thus, the

invasion of Iraq just months ahead of that date. Their determination to remain in Iraq, to

eventually invade Saudi Arabia and Iran, created a massive financial drain on the US. By

spending on the war in Iraq, the Bush administration was not spending on boosting the US

economy. Job loss and bankruptcies continued, ignored.

Fourth, the housing bubble, deliberately promoted by the Republicans and the Bush

administration in order to confuse the world and especially the American people about the

financial state of affairs. To maintain the war in Iraq, a façade of financial health was needed so

the American people would not rebel. In the short term, the construction industry boomed. But all

bubbles burst, and when they do the impact is worse than what was gained because it takes a

long time to regain confidence, a necessary ingredient for a humming economy which is

essentially based on trust.

Despite the steps taken to encourage business and industry, to provide capital, and to provide

new job starts, the underlying problems with Earth change disasters and the expense of merely

putting food on the table will continue. A wise leader can turn this tide by encouraging

alternative energy from wind, food from family gardens and cheap protein from fish ponds, and

public service by unemployed youth. These steps make for a smoother transition to the survival

communities of the future, after the pole shift. The drop from the boom times of the past, when

Wall Street was king and living on hot air, will continue. Deflated, the world will have to address

the true state of affairs, or at least will be forced in this direction.

Stressed Out

Wall Street brokers are not yet jumping out of windows, but reminders of the Great Depression were

present. Per polls, 6 of 10 people polled fear another depression around the corner.

- Poll: 60% say Depression 'Likely'

October 6, 2008

http://money.cnn.com/2008/10/06/news/economy/depression_poll/index.htm

- Nearly six out of ten Americans believe another economic depression is likely, according to

a poll. The CNN/Opinion Research Corp. poll, which surveyed more than 1,000 Americans,

cited common measures of the economic pain of the 1930s:

* 25% unemployment rate;

* widespread bank failures; and

* millions of Americans homeless and unable to feed their families.

Despair and suicide over the economic situation occurred in at least one incident in LA where an

accountant shot himself and his entire family.

- Porter Ranch Gunman's Letters Cite 'Financial Problems'

October 6, 2008

http://www.knbc.com/news/17635113/detail.html

- Karthik Rajaram, 45, was found dead with a gun in hand by police officers who followed a

trail of carnage from bedroom to bedroom through the big, two-story house in the Porter

Ranch area of the San Fernando Valley. Investigators quickly found two suicide letters and

a will, and determined that the man once worked for a major accounting firm and was at

least the part-owner of a financial holding company. The man wrote in his suicide letter

that he felt he had two options - to just kill himself or to kill himself and his family - and

decided the second option was more honorable.

A Connecticut man, angry at his losses, threatened to blow up his bank.

- Stamford Man Threatened Bank Over Financial Losses

October 8, 2008

http://www.myfoxny.com/myfox/pages/Home/Detail;

- Cops say the Wall Street crisis has had a disturbing affect on one disgruntled investor.

Police charged a 60-year-old man with threatening to blow up a bank branch in Stamford.

Authorities say he was angry about his investment losses, so he walked into a branch and

said he would kill everyone inside.

Per the Zetas, these explosions are due in part to our human tendency to repress our emotions. Thus,

they suddenly explode.

ZetaTalk Analysis 7/15/1996: The smooth surface of calm waters can be deceptive. She or he

appears so serene, so calm, their feathers never ruffled. Then one day there is an explosion, and

murder and mayhem ensue, or else suicide. Perhaps it would have been better to have a bit less

serenity, and to have been closer to the truth. The memory or awareness of various emotions is

not crucial to survival, and in fact has assisted only somewhat during civilized times. Blind rage

erupting during the day can get one fired or exiled, and thus the ability to repress emotions has

been, if anything, selected for propagation. Those who could not repress appropriately were

repelled from the tribe or city, and did not fare well enough to propagate their genes.

Not surprisingly, Americans are not taking the current economic crisis calmly. If not already affected by

job loss, bankruptcy, or the rising cost of gas and food, the plunging DOW is a source of worry. A

recent study showed the extent of this worry.

- Study: Most Americans Stressed Out By Economy

October 7, 2008

http://wcbstv.com/health/economy.stress.health.2.834942.html

- With our national economy in crisis, what does this mean for our health? Americans are so

stressed out about our economic crisis, we're irritable, fatigued, and turning to unhealthy

ways to cope. The brunt of the country's financial woes seems to take a greater toll on

women than men. New data from the American Psychological Association show 84 percent

of women are stressed out about the economy, compared with 75 percent of men. Stress

also impacts women more physically. According to the study, 56 percent of women

reported headaches due to our tough economic times, compared with 36 percent of men.

Part of the problem is stress causes illness. How we manage stress is also crucial. In times

of crisis, unhealthy approaches may seem easier, but they're often harmful. The study

reported 22 percent of men managed stress by drinking, while only 15 percent of women

turned to alcohol. Psychologists say the economic crisis creates a particularly worrisome

type of stress because for most of us, it's something we just can't control. In that way it's

similar to stress caused by fear of terrorism and of natural disasters like hurricanes and

tornadoes.

Is there any relief? Yes, per the Zetas, whose advice is simply not to engage in worry. If you can't affect

the outcome, can't change the matter, then put it aside. This is, in fact, what individuals who live long,

long lives state. If they could not change a matter, they put it aside and refused to worry.

ZetaTalk Advice 7/15/1995: Worry is the greatest drain, as the body is fighting the issues

endlessly, with no end. Your body was not designed for this. It was designed for fight or flight, not

endless battle. In your primitive past, when presented with challenges, you either fought off the

threat or were eaten or destroyed. The matter was over quickly. Modern society presents

situations that are neither over quickly nor destroy quickly. Thus the battle stage is drawn out

endlessly, and the soldiers grow weary. Put the battle to an end somehow, if only by deciding not

to engage. If there is nothing you can do at the moment, and you can have no effect on the

outcome, then put your weapons down. Be at peace. Smell the roses.

You received this Newsletter because you Subscribed to the ZetaTalk Newsletter service. If undesired, you can quickly

Unsubscribe.

|